So, in a nutshell, what are the keys to successful corporate mergers and acquisitions? What follows is my guidance and my opinions taken from a career full of M&A deals. This is practical, time-tested advice for executives desiring to grow their companies via acquisition.

So, in a nutshell, what are the keys to successful corporate mergers and acquisitions? What follows is my guidance and my opinions taken from a career full of M&A deals. This is practical, time-tested advice for executives desiring to grow their companies via acquisition.

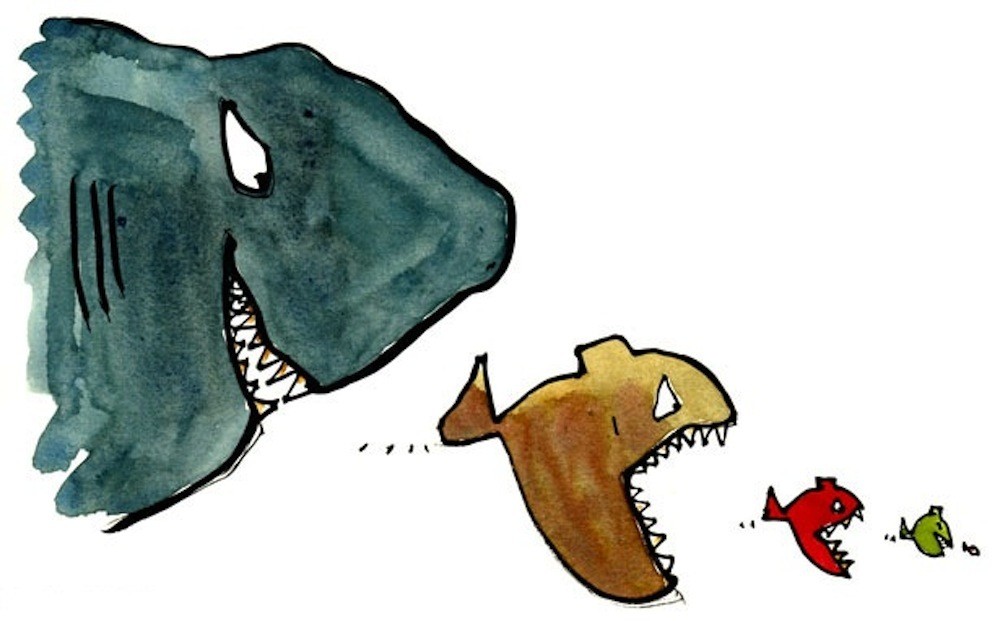

First, let’s get something straight. Good corporate M&A isn’t luck. Rather, it’s the culmination of a disciplined process wherein the right people find the right deal at the right time and the right price. Judiciously used, corporate M&A is perhaps the most powerful business tool available for achieving size, scale, and diversity, obtaining critical technology, and securing competitive advantage. Good corporate acquisitions both protect and grow shareholder value.

Of course, many pitfalls await — paying too much, losing key employees, misjudging industry considerations, missing red flags in due diligence, becoming bogged in integration problems, and litigation, among others. Most acquisition problems can be avoided by following sound acquisition procedure and deliberately instilling standardized practices in the acquisition program that minimize the amount of miscommunication, mistakes, and disruption.

This 3 part-posting will examine the key personnel, procedural, and investment rationales that I believe maximize the chances for corporate M&A success.

Part One: People/The M&A Team

In my opinion, more than any other factor, the proper choice of the M&A team dictates an organization’s chances for M&A success. M&A is after all very much a people business, and matching the right personnel to the right role is critical. Team members are functionally spread thin, acquiring new companies, integrating acquired companies, and performing their core, non-acquisition related duties. It is imperative that the M&A team be kept small, focused, highly organized, and above all capable of working well together.

The core members of the M&A team should include:

- Board of Directors: The M&A process should begin and end with the Board

of Directors, but the Board should also be kept well informed throughout

the process. The Board should include members who are experienced

in M&A and embrace growth via acquisition. Prior to beginning the

process, the Board should approve the proposed size, customer profile,

characteristics, and profitability of companies to be pursued.

- Chief Executive Officer: The CEO should be a strong leader capable of

solving integration problems, knitting together diverse cultures, and overcoming

natural human aversion to change. Ideally, the CEO should also be an established industry figure who will serve as an enticement for potential acquisition targets.

- Chief Financial Officer: In addition to regular duties, the CFO should be capable of performing specialized tasks related to acquisitions, including i) managing wide-ranging integration issues, ii) creating and enforcing standardized practices for financial reporting, budgeting, and compliance, iii) raising capital for acquisitions, and iv) communicating acquisition rationale and results to the investment community.

- Corporate Development Officer: This individual is the most important member of the M&A team, serving as the company’s central, accountable acquisition authority. The CDO should be responsible for managing all internal and external aspects of the acquisition program, including origination, valuing, structuring, negotiation, due diligence, and closing elements. In addition, the CDO should undertake various strategic planning duties, including industry and competitive analysis.

- Operations Team: A small team of operationally experienced individuals should be responsible for implementing and overseeing an integration plan constructed from the top down.

And don’t forget the external team — the service providers. Some acquisition functions cannot and should not be handled in-house:

- Due Diligence: Internal operations managers should visit target companies early and often during the buying process. Depending upon the activity of the acquisition program, travel, time, and skill sets required (such as accounting), due diligence may be best handled by the staff of a national accounting firm. If possible, I recommend that the due diligence firm be the same accounting firm handling the acquirer’s audit function.

- Acquisition Counsel: Using internally developed form documents and agreements, experienced outside counsel can leverage inside counsel’s time and effort in the acquisition function.

- Real Estate: Again, depending upon the activity of the acquisition program, issues pertaining to both acquisition real estate and existing real estate portfolio consolidation may be most efficiently handled by a national real estate services provider.

- Environmental Analysis: Assessment of environmental risk, unfortunately now a major

risk in all acquisitions, is best outsourced to specialized consultants.

- Employee Benefits Analysis: Assessment of employee benefits and related compliance risk in acquisitions requires highly specific, and current knowledge and should be outsourced.

Next, the Acquisition Procedures necessary for Successful Corporate M&A (Part Two)

Posted by: Mory Watkins

So, in a nutshell, what are the keys to successful corporate mergers and acquisitions? What follows is my guidance and my opinions taken from a career full of M&A deals. This is practical, time-tested advice for executives desiring to grow their companies via acquisition.

So, in a nutshell, what are the keys to successful corporate mergers and acquisitions? What follows is my guidance and my opinions taken from a career full of M&A deals. This is practical, time-tested advice for executives desiring to grow their companies via acquisition.